Page 88 - CCL AR 2017 Final

P. 88

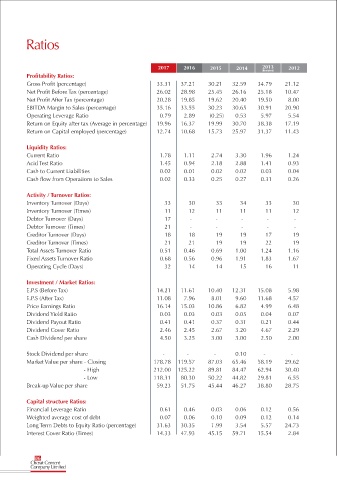

Ratios

2017 2016 2015 2014 2013 2012

(Restated)

Profitability Ratios:

Gross Profit (percentage) 33.31 37.21 30.21 32.59 34.79 21.12

Net Profit Before Tax (percentage) 26.02 28.98 25.45 26.16 25.18 10.47

Net Profit After Tax (percentage) 20.28 19.85 19.62 20.40 19.50 8.00

EBITDA Margin to Sales (percentage) 35.16 33.55 30.23 30.65 30.91 20.90

Operating Leverage Ratio 0.79 2.89 (0.25) 0.53 5.97 5.54

Return on Equity after tax (Average in percentage) 19.96 16.37 19.99 30.70 38.38 17.19

Return on Capital employed (percentage) 12.74 10.68 15.73 25.97 31.37 11.43

Liquidity Ratios:

Current Ratio 1.78 1.11 2.74 3.30 1.96 1.24

Acid Test Ratio 1.45 0.94 2.18 2.88 1.41 0.93

Cash to Current Liabilities 0.02 0.01 0.02 0.02 0.03 0.04

Cash flow from Operations to Sales 0.02 0.33 0.25 0.27 0.31 0.26

Activity / Turnover Ratios:

Inventory Turnover (Days) 33 30 33 34 33 30

Inventory Turnover (Times) 11 12 11 11 11 12

Debtor Turnover (Days) 17 - - - - -

Debtor Turnover (Times) 21 - - - - -

Creditor Turnover (Days) 18 18 19 19 17 19

Creditor Turnover (Times) 21 21 19 19 22 19

Total Assets Turnover Ratio 0.51 0.46 0.69 1.00 1.24 1.16

Fixed Assets Turnover Ratio 0.68 0.56 0.96 1.91 1.83 1.67

Operating Cycle (Days) 32 14 14 15 16 11

Investment / Market Ratios:

E.P.S (Before Tax) 14.21 11.61 10.40 12.31 15.08 5.98

E.P.S (After Tax) 11.08 7.96 8.01 9.60 11.68 4.57

Price Earnings Ratio 16.14 15.03 10.86 6.82 4.99 6.48

Dividend Yield Ratio 0.03 0.03 0.03 0.05 0.04 0.07

Dividend Payout Ratio 0.41 0.41 0.37 0.31 0.21 0.44

Dividend Cover Ratio 2.46 2.45 2.67 3.20 4.67 2.29

Cash Dividend per share 4.50 3.25 3.00 3.00 2.50 2.00

Stock Dividend per share - - - 0.10 - -

Market Value per share - Closing 178.78 119.57 87.03 65.46 58.19 29.62

- High 212.00 125.22 89.81 84.47 62.94 30.40

- Low 118.31 80.30 50.22 44.82 29.81 6.55

Break-up Value per share 59.23 51.75 45.44 46.27 38.80 28.75

Capital structure Ratios:

Financial Leverage Ratio 0.61 0.46 0.03 0.06 0.12 0.56

Weighted average cost of debt 0.07 0.06 0.10 0.09 0.12 0.14

Long Term Debts to Equity Ratio (percentage) 31.63 30.35 1.99 3.54 5.57 24.73

Interest Cover Ratio (Times) 14.33 47.93 45.15 59.71 15.54 2.84

86

Cherat Cement

Company Limited