Page 84 - CCL AR 2017 Final

P. 84

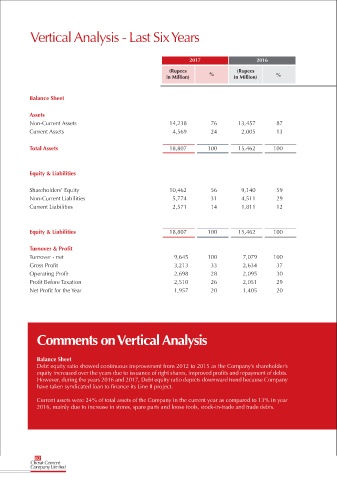

Vertical Analysis - Last Six Years

2017 2016

(Rupees (Rupees

in Million) % in Million) %

Balance Sheet

Assets

Non-Current Assets 14,238 76 13,457 87 7,197 76 3,526 55 3,531 70 3,422 73

Current Assets 4,569 24 2,005 13 2,267 24 2,905 45 1,534 30 1,289 27

Total Assets 18,807 100 15,462 100 9,464 100 6,431 100 5,065 100 4,711 100

Equity & Liabilities

Shareholders’ Equity 10,462 56 9,140 59 8,026 85 4,864 75 3,709 73 2,748 58

Non-Current Liabilities 5,774 31 4,511 29 611 6 686 11 574 11 923 20

Current Liabilities 2,571 14 1,811 12 827 9 881 14 782 16 1,040 22

Equity & Liabilities 18,807 100 15,462 100 9,464 100 6,431 100 5,065 100 4,711 100

Turnover & Profit

Turnover - net 9,645 100 7,079 100 6,565 100 6,451 100 6,294 100 5,457 100

Gross Profit 3,213 33 2,634 37 1,984 30 2,103 33 2,190 35 1,152 21

Operating Profit 2,698 28 2,095 30 1,709 26 1,716 27 1,694 27 882 16

Profit Before Taxation 2,510 26 2,051 29 1,671 25 1,688 26 1,585 25 572 10

Net Profit for the Year 1,957 20 1,405 20 1,288 19 1,316 20 1,228 20 437 8

Comments on Vertical Analysis

Balance Sheet Profit and Loss Account

Debt equity ratio showed continuous improvement from 2012 to 2015 as the Company’s shareholder’s Gross profit increased from 21% to 33% from years 2012 to 2017 mainly due to increased sales turnover.

equity increased over the years due to issuance of right shares, improved profits and repayment of debts. Operating profit was 16% of turnover in year 2012 which has increased to 28% in year 2017 mainly due

However, during the years 2016 and 2017, Debt equity ratio depicts downward trend because Company to improved gross profit margin.

have taken syndicated loan to finance its Line II project.

Current assets were 24% of total assets of the Company in the current year as compared to 13% in year

2016, mainly due to increase in stores, spare parts and loose tools, stock-in-trade and trade debts.

82

Cherat Cement

Company Limited