Page 142 - CCL AR 2017 Final

P. 142

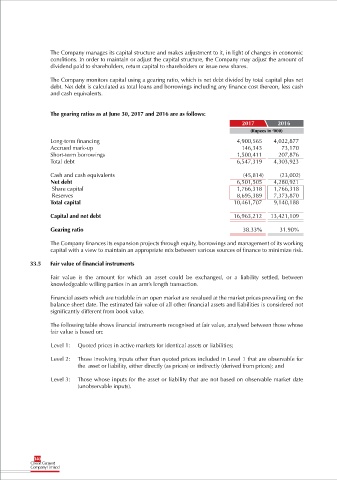

The Company manages its capital structure and makes adjustment to it, in light of changes in economic

conditions. In order to maintain or adjust the capital structure, the Company may adjust the amount of

dividend paid to shareholders, return capital to shareholders or issue new shares.

The Company monitors capital using a gearing ratio, which is net debt divided by total capital plus net

debt. Net debt is calculated as total loans and borrowings including any finance cost thereon, less cash

and cash equivalents.

The gearing ratios as at June 30, 2017 and 2016 are as follows:

2017 2016

(Rupees in ‘000)

Long-term financing 4,900,565 4,022,877

Accrued mark-up 146,343 73,170

Short-term borrowings 1,500,411 207,876

Total debt 6,547,319 4,303,923

Cash and cash equivalents (45,814) (23,002)

Net debt 6,501,505 4,280,921

Share capital 1,766,318 1,766,318

Reserves 8,695,389 7,373,870

Total capital 10,461,707 9,140,188

Capital and net debt 16,963,212 13,421,109

Gearing ratio 38.33% 31.90%

The Company finances its expansion projects through equity, borrowings and management of its working

capital with a view to maintain an appropriate mix between various sources of finance to minimize risk.

33.5 Fair value of financial instruments

Fair value is the amount for which an asset could be exchanged, or a liability settled, between

knowledgeable willing parties in an arm’s length transaction.

Financial assets which are tradable in an open market are revalued at the market prices prevailing on the

balance sheet date. The estimated fair value of all other financial assets and liabilities is considered not

significantly different from book value.

The following table shows financial instruments recognised at fair value, analysed between those whose

fair value is based on:

Level 1: Quoted prices in active markets for identical assets or liabilities;

Level 2: Those involving inputs other than quoted prices included in Level 1 that are observable for

the asset or liability, either directly (as prices) or indirectly (derived from prices); and

Level 3: Those whose inputs for the asset or liability that are not based on observable market date

(unobservable inputs).

140