Page 141 - CCL AR 2017 Final

P. 141

33.2 Credit risk

Credit risk is the risk that counterparty will not meet its obligations under a financial instrument or

customer contract, leading to a financial loss. The Company’s exposure to credit risk is minimal as the

Company receives advance against sales.

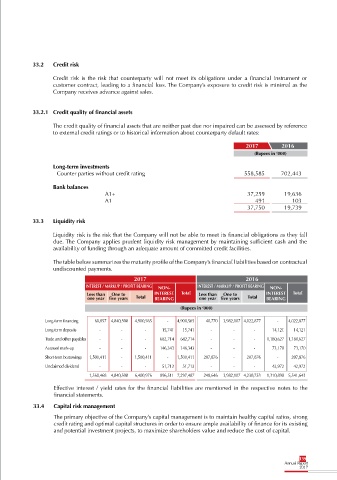

33.2.1 Credit quality of financial assets

The credit quality of financial assets that are neither past due nor impaired can be assessed by reference

to external credit ratings or to historical information about counterparty default rates:

2017 2016

(Rupees in ‘000)

Long-term investments

Counter parties without credit rating 558,585 702,443

Bank balances

A1+ 37,259 19,636

A1 491 103

37,750 19,739

33.3 Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall

due. The Company applies prudent liquidity risk management by maintaining sufficient cash and the

availability of funding through an adequate amount of committed credit facilities.

The table below summarizes the maturity profile of the Company’s financial liabilities based on contractual

undiscounted payments.

2017 2016

INTEREST / MARKUP / PROFIT BEARING NON- INTEREST / MARKUP / PROFIT BEARING NON-

Less than One to INTEREST Total Less than One to INTEREST Total

one year five years Total BEARING one year five years Total BEARING

(Rupees in ‘000)

Long-term financing 60,057 4,840,508 4,900,565 - 4,900,565 40,770 3,982,107 4,022,877 - 4,022,877

Long-term deposits - - - 15,741 15,741 - - - 14,121 14,121

Trade and other payables - - - 682,714 682,714 - - - 1,180,627 1,180,627

Accrued mark-up - - - 146,343 146,343 - - - 73,170 73,170

Short-term borrowings 1,500,411 - 1,500,411 - 1,500,411 207,876 - 207,876 - 207,876

Unclaimed dividend - - - 51,713 51,713 - - - 42,972 42,972

1,560,468 4,840,508 6,400,976 896,511 7,297,487 248,646 3,982,107 4,230,753 1,310,890 5,541,643

Effective interest / yield rates for the financial liabilities are mentioned in the respective notes to the

financial statements.

33.4 Capital risk management

The primary objective of the Company’s capital management is to maintain healthy capital ratios, strong

credit rating and optimal capital structures in order to ensure ample availability of finance for its existing

and potential investment projects, to maximize shareholders value and reduce the cost of capital.

139