Page 140 - CCL AR 2017 Final

P. 140

The Company’s senior management oversees the management of these risks. The Company’s senior

management provides policies for overall risk management, as well as policies covering specific areas

such as foreign exchange risk, interest rate risk, and credit risk, use of financial derivatives, financial

instruments and investment of excess liquidity. It is the Company’s policy that no trading in derivatives for

speculative purposes shall be undertaken. The Board of Directors review and agree policies for managing

each of these risks which are summarized below:

33.1 Market risk

Market risk is the risk that fair value of future cash flows will fluctuate because of changes in market

prices. Market prices comprise three types of risk: interest rate risk, currency risk and equity price risk,

such as equity risk.

33.1.1 Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of the financial instruments will fluctuate

because of changes in the market interest rates. The Company’s interest rate risk arises from long-term and

short-term borrowings obtained with floating rates. All the borrowings of the Company are obtained in

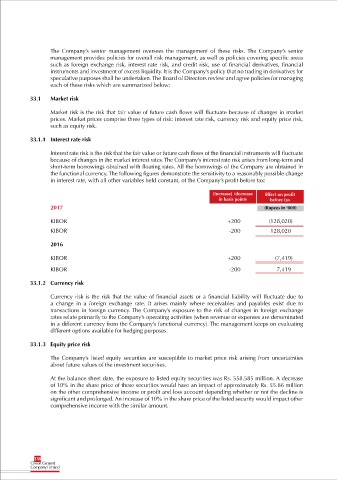

the functional currency. The following figures demonstrate the sensitivity to a reasonably possible change

in interest rate, with all other variables held constant, of the Company’s profit before tax:

(Increase) /decrease Effect on profit

in basis points before tax

2017 (Rupees in ‘000)

KIBOR +200 (128,020)

KIBOR -200 128,020

2016

KIBOR +200 (7,419)

KIBOR -200 7,419

33.1.2 Currency risk

Currency risk is the risk that the value of financial assets or a financial liability will fluctuate due to

a change in a foreign exchange rate. It arises mainly where receivables and payables exist due to

transactions in foreign currency. The Company’s exposure to the risk of changes in foreign exchange

rates relate primarily to the Company’s operating activities (when revenue or expenses are denominated

in a different currency from the Company’s functional currency). The management keeps on evaluating

different options available for hedging purposes.

33.1.3 Equity price risk

The Company’s listed equity securities are susceptible to market price risk arising from uncertainties

about future values of the investment securities.

At the balance sheet date, the exposure to listed equity securities was Rs. 558.585 million. A decrease

of 10% in the share price of these securities would have an impact of approximately Rs. 55.86 million

on the other comprehensive income or profit and loss account depending whether or not the decline is

significant and prolonged. An increase of 10% in the share price of the listed security would impact other

comprehensive income with the similar amount.

138