Page 139 - CCL AR 2017 Final

P. 139

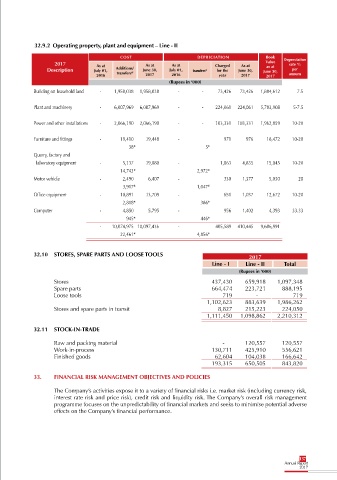

32.9.2 Operating property, plant and equipment – Line - II

COST DEPRICIATION Book Depreciation

2017 As at As at As at Charged As at Value rate %

as at

Description July 01, Additions/ June 30, July 01, transfers* for the June 30, June 30, per

2016 transfers* 2017 2016 year 2017 2017 annum

(Rupees in ‘000)

Building on leasehold land - 1,958,038 1,958,038 - - 73,426 73,426 1,884,612 7.5

Plant and machinery - 6,007,969 6,007,969 - - 224,061 224,061 5,783,908 5-7.5

Power and other installations - 2,066,190 2,066,190 - - 103,331 103,331 1,962,859 10-20

Furniture and fittings - 19,410 19,448 - 971 976 18,472 10-20

38* 5*

Quarry, factory and

laboratory equipment - 5,137 19,880 - 1,863 4,835 15,045 10-20

14,743* 2,972*

Motor vehicle - 2,490 6,407 - 330 1,377 5,030 20

3,917* 1,047*

Office equipment - 10,891 13,709 - 651 1,037 12,672 10-20

2,818* 386*

Computer - 4,850 5,795 - 956 1,402 4,393 33.33

945* 446*

- 10,074,975 10,097,436 - 405,589 410,445 9,686,991

22,461* 4,856*

32.10 STORES, SPARE PARTS AND LOOSE TOOLS 2017

Line - I Line - II Total

(Rupees in ‘000)

Stores 437,430 659,918 1,097,348

Spare parts 664,474 223,721 888,195

Loose tools 719 - 719

1,102,623 883,639 1,986,262

Stores and spare parts in transit 8,827 215,223 224,050

1,111,450 1,098,862 2,210,312

32.11 STOCK-IN-TRADE

Raw and packing material - 120,557 120,557

Work-in-process 130,711 425,910 556,621

Finished goods 62,604 104,038 166,642

193,315 650,505 843,820

33. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

The Company’s activities expose it to a variety of financial risks i.e. market risk (including currency risk,

interest rate risk and price risk), credit risk and liquidity risk. The Company’s overall risk management

programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse

effects on the Company’s financial performance.

137