Page 134 - CCL AR 2017 Final

P. 134

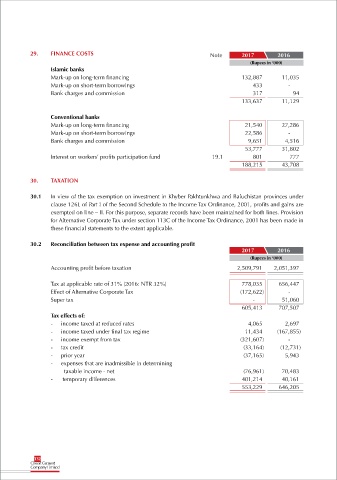

29. FINANCE COSTS Note 2017 2016

(Rupees in ‘000)

Islamic banks

Mark-up on long-term financing 132,887 11,035

Mark-up on short-term borrowings 433 -

Bank charges and commission 317 94

133,637 11,129

Conventional banks

Mark-up on long-term financing 21,540 27,286

Mark-up on short-term borrowings 22,586 -

Bank charges and commission 9,651 4,516

53,777 31,802

Interest on workers’ profits participation fund 19.1 801 777

188,215 43,708

30. TAXATION

30.1 In view of the tax exemption on investment in Khyber Pakhtunkhwa and Baluchistan provinces under

clause 126L of Part I of the Second Schedule to the Income Tax Ordinance, 2001, profits and gains are

exempted on line – II. For this purpose, separate records have been maintained for both lines. Provision

for Alternative Corporate Tax under section 113C of the Income Tax Ordinance, 2001 has been made in

these financial statements to the extent applicable.

30.2 Reconciliation between tax expense and accounting profit

2017 2016

(Rupees in ‘000)

Accounting profit before taxation 2,509,791 2,051,397

Tax at applicable rate of 31% (2016: NTR 32%) 778,035 656,447

Effect of Alternative Corporate Tax (172,622) -

Super tax - 51,060

605,413 707,507

Tax effects of:

- income taxed at reduced rates 4,065 2,697

- income taxed under final tax regime 11,434 (167,855)

- income exempt from tax (321,607) -

- tax credit (33,164) (12,731)

- prior year (37,165) 5,943

- expenses that are inadmissible in determining

taxable income - net (76,961) 70,483

- temporary differences 401,214 40,161

553,229 646,205

132