Page 131 - CCL AR 2017 Final

P. 131

complications which were brought into the knowledge of HLHC by amending the Company’s appeal. The

Honourable Supreme Court of Pakistan has now referred the matter to the Appellate Tribunal constituted

by the CCP which has not started its proceedings yet. Accordingly, the management, based on the legal

advice, believes that there are good legal grounds and is hopeful that there will be no adverse outcome

for the Company and therefore, no provision for the above penalty has been made in these financial

statements.

22.1.4 During the year ended June 30, 2013, the Company won a petition in the Honourable Sindh High Court

against Special Excise Duty (SED) levied by the FBR under section 3A of the Federal Excise Act 2005 and

SRO 655(1) / 2007 dated June 06, 2007 for the period from July 2007 to June 2011. This has resulted in

a refund claim of Rs. 100.08 million. However, the FBR has challenged this decision in the Honourable

Supreme Court of Pakistan where it is pending for adjudication. Keeping in view the uncertainties involved

in the realisation of such refunds, no amount of income has been recognised in these financial statements.

22.1.5 Government of Sindh imposed an infrastructure fee on the goods entering or leaving the province through

the Sindh Finance (Amendment) Ordinance, 2007 which was challenged in the Honourable Sindh

High Court. The Honourable Sindh High Court granted an agreed upon interim relief in May 2011, in

consultation with the petitioners and the Secretary Excise and Taxation Department (the Department),

whereby the goods of petitioners will be cleared by the Excise and Taxation Department on payment of

50% of the disputed amount and on furnishing bank guarantee for the balance 50% amount till the final

outcome of the case.

The Company became a party to the arrangement in February 2014 and issued bank guarantees in

favour of the Department. The amount of guarantee issued up to June 30, 2017 is Rs. 54 million. The

management is hopeful of a favorable outcome and accordingly no provision has been made on these

financial statements against the levy.

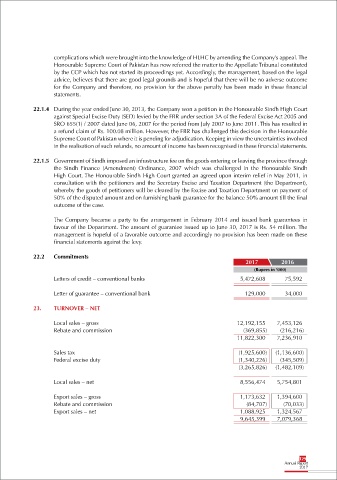

22.2 Commitments

2017 2016

(Rupees in ‘000)

Letters of credit – conventional banks 5,472,608 75,592

Letter of guarantee – conventional bank 129,000 34,000

23. TURNOVER – NET

Local sales – gross 12,192,155 7,453,126

Rebate and commission (369,855) (216,216)

11,822,300 7,236,910

Sales tax (1,925,600) (1,136,600)

Federal excise duty (1,340,226) (345,509)

(3,265,826) (1,482,109)

Local sales – net 8,556,474 5,754,801

Export sales – gross 1,173,632 1,394,600

Rebate and commission (84,707) (70,033)

Export sales – net 1,088,925 1,324,567

9,645,399 7,079,368

129