Page 129 - CCL AR 2017 Final

P. 129

19.2 Workers’ Welfare Fund (WWF)

As per WWF Ordinance, 1971, WWF was chargeable @ 2% of the taxable income. The Federal

government through Finance Acts 2006 and 2008 amended the WWF Ordinance, 1971, where by the

term `total income` shall be considered as profit before taxation as per declaration of income in the return

or as per accounts, whichever is higher. These amendments were challenged by the Company and other

taxpayers in the Honourable Peshawar High Court who decided the case in their favor in the year 2013-

14.

The Tax department filed an appeal against the order of the Honourable Peshawar High Court in the

Honourable Supreme Court who decided the case in favour of the taxpayers. Accordingly the Company

has reversed the charge for WWF in respect of prior years’ amounting to Rs. 35.040 million.

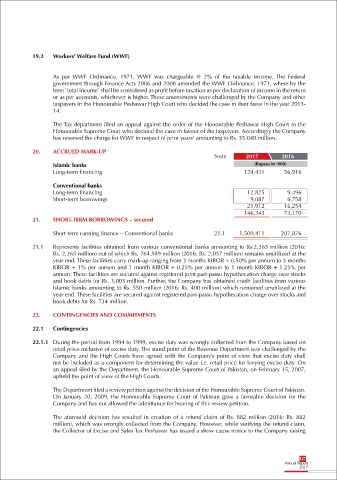

20. ACCRUED MARK-UP

Note 2017 2016

Islamic banks (Rupees in ‘000)

Long-term financing 124,431 56,916

Conventional banks

Long-term financing 12,825 9,496

Short-term borrowings 9,087 6,758

21,912 16,254

146,343 73,170

21. SHORT-TERM BORROWINGS – secured

Short-term running finance – Conventional banks 21.1 1,500,411 207,876

21.1 Represents facilities obtained from various conventional banks amounting to Rs.2,265 million (2016:

Rs. 2,265 million) out of which Rs. 764.589 million (2016: Rs. 2,057 million) remains unutilized at the

year end. These facilities carry mark-up ranging from 3 months KIBOR + 0.50% per annum to 3 months

KIBOR + 1% per annum and 1 month KIBOR + 0.25% per annum to 1 month KIBOR + 1.25% per

annum. These facilities are secured against registered joint pari-passu hypothecation charge over stocks

and book debts for Rs. 3,003 million. Further, the Company has obtained credit facilities from various

Islamic banks amounting to Rs. 550 million (2016: Rs. 400 million) which remained unutilized at the

year end. These facilities are secured against registered pari-passu hypothecation charge over stocks and

book debts for Rs. 734 million.

22. CONTINGENCIES AND COMMITMENTS

22.1 Contingencies

22.1.1 During the period from 1994 to 1999, excise duty was wrongly collected from the Company based on

retail price inclusive of excise duty. The stand point of the Revenue Department was challenged by the

Company and the High Courts have agreed with the Company’s point of view that excise duty shall

not be included as a component for determining the value i.e. retail price for levying excise duty. On

an appeal filed by the Department, the Honourable Supreme Court of Pakistan, on February 15, 2007,

upheld the point of view of the High Courts.

The Department filed a review petition against the decision of the Honourable Supreme Court of Pakistan.

On January 20, 2009, the Honourable Supreme Court of Pakistan gave a favorable decision for the

Company and has not allowed the admittance for hearing of this review petition.

The aforesaid decision has resulted in creation of a refund claim of Rs. 882 million (2016: Rs. 882

million), which was wrongly collected from the Company. However, while verifying the refund claim,

the Collector of Excise and Sales Tax Peshawar has issued a show cause notice to the Company raising

127