Page 126 - CCL AR 2017 Final

P. 126

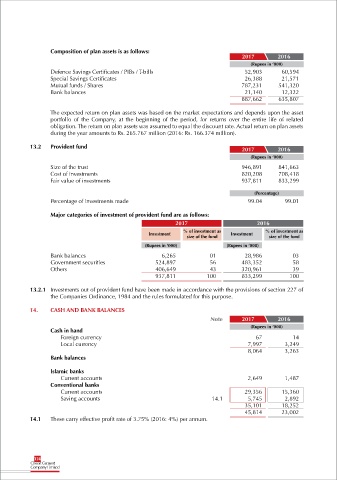

Composition of plan assets is as follows:

2017 2016

(Rupees in ‘000)

Defence Savings Certificates / PIBs / T-bills 52,903 60,594

Special Savings Certificates 26,388 21,571

Mutual funds / Shares 787,231 541,320

Bank balances 21,140 12,322

887,662 635,807

The expected return on plan assets was based on the market expectations and depends upon the asset

portfolio of the Company, at the beginning of the period, for returns over the entire life of related

obligation. The return on plan assets was assumed to equal the discount rate. Actual return on plan assets

during the year amounts to Rs. 265.767 million (2016: Rs. 166.374 million).

13.2 Provident fund 2017 2016

(Rupees in ‘000)

Size of the trust 946,891 841,663

Cost of investments 820,208 708,418

Fair value of investments 937,811 833,299

(Percentage)

Percentage of investments made 99.04 99.01

Major categories of investment of provident fund are as follows:

2017 2016

% of investment as % of investment as

Investment size of the fund Investment size of the fund

(Rupees in ‘000) (Rupees in ‘000)

Bank balances 6,265 01 28,986 03

Government securities 524,897 56 483,352 58

Others 406,649 43 320,961 39

937,811 100 833,299 100

13.2.1 Investments out of provident fund have been made in accordance with the provisions of section 227 of

the Companies Ordinance, 1984 and the rules formulated for this purpose.

14. CASH AND BANK BALANCES

Note 2017 2016

(Rupees in ‘000)

Cash in hand

Foreign currency 67 14

Local currency 7,997 3,249

8,064 3,263

Bank balances

Islamic banks

Current accounts 2,649 1,487

Conventional banks

Current accounts 29,356 15,360

Saving accounts 14.1 5,745 2,892

35,101 18,252

45,814 23,002

14.1 These carry effective profit rate of 3.75% (2016: 4%) per annum.

124