Page 128 - CCL AR 2017 Final

P. 128

17.1 During the year, the loan has been settled early.

17.2 Represents long-term financing obtained from Islamic banks under Diminishing Musharika Scheme

and a term loan from a conventional bank. The approved loan is Rs. 9,500 million (Rs. 7,800 million

under Islamic finance and Rs. 1,700 million under conventional finance) out of which Rs. 5,500 million

remained unutilized. Carrying mark-up at the rate of 6 months KIBOR + 0.7% per annum. The financing

is repayable in 10 equal semi-annual installments commencing after a grace period of 36 months from the

date of first draw down i.e. March 2019. The financing is secured against first pari-passu hypothecation

charge of Rs. 12,670 million on plant and machinery and immovable fixed assets.

17.3 Represents a long-term financing obtained from an Islamic bank under Diminishing Musharika Scheme.

The approved loan is Rs. 700 million out of which Rs. 99.44 million remained unutilized. Carrying mark-

up at the rate of 6 months KIBOR+ 0.7% per annum. The financing is repayable in 10 equal semi-annual

installments commencing after 30 months from first draw down i.e. February 2018. The financing is

secured against first pari-passu hypothecation charge of Rs. 934 million on plant and machinery.

17.4 Represents a long-term financing obtained from an Islamic bank under the Diminishing Musharika

Scheme, carrying profit at the rate of 6 months KIBOR + 0.7% per annum. The financing is repayable in 6

equal semi-annual installments commencing after 30 months from first drawdown from December 2018.

The financing is secured against registered first pari-passu hypothecation charge of Rs. 400 million on

plant and machinery.

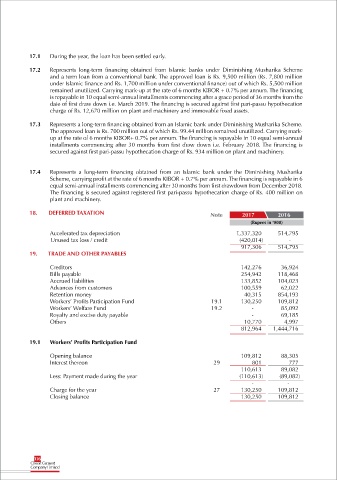

18. DEFERRED TAXATION Note 2017 2016

(Rupees in ‘000)

Accelerated tax depreciation 1,337,320 514,795

Unused tax loss / credit (420,014) -

917,306 514,795

19. TRADE AND OTHER PAYABLES

Creditors 142,276 36,924

Bills payable 254,942 118,468

Accrued liabilities 133,852 104,023

Advances from customers 100,559 62,022

Retention money 40,315 854,193

Workers’ Profits Participation Fund 19.1 130,250 109,812

Workers’ Welfare Fund 19.2 - 85,092

Royalty and excise duty payable - 69,185

Others 10,770 4,997

812,964 1,444,716

19.1 Workers’ Profits Participation Fund

Opening balance 109,812 88,305

Interest thereon 29 801 777

110,613 89,082

Less: Payment made during the year (110,613) (89,082)

- -

Charge for the year 27 130,250 109,812

Closing balance 130,250 109,812

126