Page 124 - CCL AR 2017 Final

P. 124

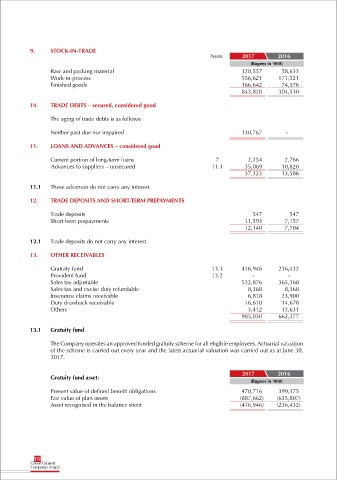

9. STOCK-IN-TRADE

Note 2017 2016

(Rupees in ‘000)

Raw and packing material 120,557 58,633

Work-in-process 556,621 171,321

Finished goods 166,642 74,576

843,820 304,530

10. TRADE DEBTS – secured, considered good

The aging of trade debts is as follows:

Neither past due nor impaired 130,767 -

11. LOANS AND ADVANCES – considered good

Current portion of long-term loans 7 2,254 2,766

Advances to suppliers – unsecured 11.1 35,069 10,820

37,323 13,586

11.1 These advances do not carry any interest.

12. TRADE DEPOSITS AND SHORT-TERM PREPAYMENTS

Trade deposits 547 547

Short-term prepayments 11,593 7,157

12,140 7,704

12.1 Trade deposits do not carry any interest.

13. OTHER RECEIVABLES

Gratuity fund 13.1 416,946 236,432

Provident fund 13.2 - -

Sales tax adjustable 532,876 365,368

Sales tax and excise duty refundable 8,368 8,368

Insurance claims receivable 6,818 23,900

Duty drawback receivable 16,610 14,678

Others 3,412 13,631

985,030 662,377

13.1 Gratuity fund

The Company operates an approved funded gratuity scheme for all eligible employees. Actuarial valuation

of the scheme is carried out every year and the latest actuarial valuation was carried out as at June 30,

2017.

2017 2016

Gratuity fund asset:

(Rupees in ‘000)

Present value of defined benefit obligations 470,716 399,375

Fair value of plan assets (887,662) (635,807)

Asset recognised in the balance sheet (416,946) (236,432)

122