Page 123 - CCL AR 2017 Final

P. 123

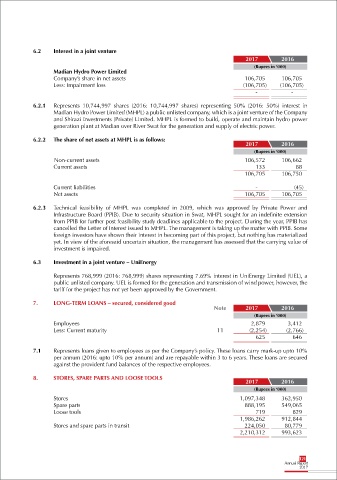

6.2 Interest in a joint venture

2017 2016

(Rupees in ‘000)

Madian Hydro Power Limited

Company’s share in net assets 106,705 106,705

Less: Impairment loss (106,705) (106,705)

- -

6.2.1 Represents 10,744,997 shares (2016: 10,744,997 shares) representing 50% (2016: 50%) interest in

Madian Hydro Power Limited (MHPL) a public unlisted company, which is a joint venture of the Company

and Shirazi Investments (Private) Limited. MHPL is formed to build, operate and maintain hydro power

generation plant at Madian over River Swat for the generation and supply of electric power.

6.2.2 The share of net assets at MHPL is as follows:

2017 2016

(Rupees in ‘000)

Non-current assets 106,572 106,662

Current assets 133 88

106,705 106,750

Current liabilities - (45)

Net assets 106,705 106,705

6.2.3 Technical feasibility of MHPL was completed in 2009, which was approved by Private Power and

Infrastructure Board (PPIB). Due to security situation in Swat, MHPL sought for an indefinite extension

from PPIB for further post feasibility study deadlines applicable to the project. During the year, PPIB has

cancelled the Letter of Interest issued to MHPL. The management is taking up the matter with PPIB. Some

foreign investors have shown their interest in becoming part of this project, but nothing has materialized

yet. In view of the aforesaid uncertain situation, the management has assessed that the carrying value of

investment is impaired.

6.3 Investment in a joint venture – UniEnergy

Represents 768,999 (2016: 768,999) shares representing 7.69% interest in UniEnergy Limited (UEL), a

public unlisted company. UEL is formed for the generation and transmission of wind power, however, the

tariff for the project has not yet been approved by the Government.

7. LONG-TERM LOANS – secured, considered good

Note 2017 2016

(Rupees in ‘000)

Employees 2,879 3,412

Less: Current maturity 11 (2,254) (2,766)

625 646

7.1 Represents loans given to employees as per the Company’s policy. These loans carry mark-up upto 10%

per annum (2016: upto 10% per annum) and are repayable within 3 to 6 years. These loans are secured

against the provident fund balances of the respective employees.

8. STORES, SPARE PARTS AND LOOSE TOOLS

2017 2016

(Rupees in ‘000)

Stores 1,097,348 362,950

Spare parts 888,195 549,065

Loose tools 719 829

1,986,262 912,844

Stores and spare parts in transit 224,050 80,779

2,210,312 993,623

121