Page 117 - CCL AR 2017 Final

P. 117

Deferred tax is calculated at the rates that are expected to apply to the period when the differences

reverse, based on tax rates that have been enacted or substantively enacted by the balance sheet date.

In this regard, the effects on deferred taxation of the portion of income expected to be subject to final

tax regime is adjusted in accordance with the requirement of Accounting Technical Release - 27 of the

Institute of Chartered Accountants of Pakistan.

3.15 Sales tax

Revenues, expenses and assets are recognized, net off amount of sales tax except:

- Where sales tax incurred on a purchase of asset or service is not recoverable from the taxation

authorities, in which case the sales tax is recognised as part of the cost of acquisition of the asset or

as part of the expense item as applicable;

- Receivables or payables that are stated with the amount of sales tax included; and

- The net amount of sales tax recoverable from, or payable to, the taxation authorities is included as

part of receivables or payables in the balance sheet.

3.16 Borrowing costs

Borrowing costs directly attributable to the acquisition, construction or production of an asset that

necessarily takes a substantial period of time to get ready for its intended use or sale are capitalized as

part of the cost of the respective assets. All other borrowing costs are expensed in the period in which

they occur. Borrowing costs consist of interest and other costs that an entity incurs in connection with the

borrowing of funds.

3.17 Impairment

The carrying value of the Company’s assets except for inventories and deferred tax assets are reviewed

at each balance sheet date to determine whether there is any indication of impairment. If any such

indication exists the asset’s recoverable amount is estimated and impairment losses are recognised in the

profit and loss account.

3.18 Dividend and appropriation to reserves

Dividend and appropriation to reserves are recognised in the financial statements in the period in which

these are approved.

3.19 Functional and presentation currency

These financial statements are presented in Pak Rupees, which is the Company’s functional and presentation

currency.

3.20 Segment reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the

management. Management monitors the operating results of its business segments separately for the

purpose of making decisions about resource allocation and performance assessment.

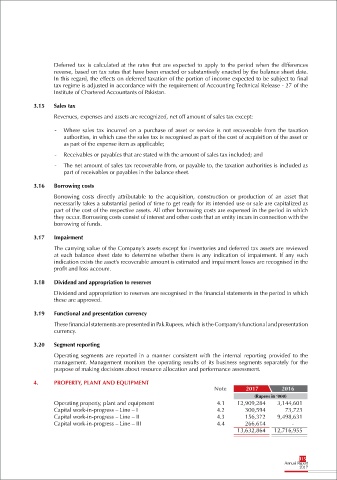

4. PROPERTY, PLANT AND EQUIPMENT

Note 2017 2016

(Rupees in ‘000)

Operating property, plant and equipment 4.1 12,909,284 3,144,601

Capital work-in-progress – Line – I 4.2 300,594 73,723

Capital work-in-progress – Line – II 4.3 156,372 9,498,631

Capital work-in-progress – Line – III 4.4 266,614 -

13,632,864 12,716,955

115