Page 104 - CCL AR 2017 Final

P. 104

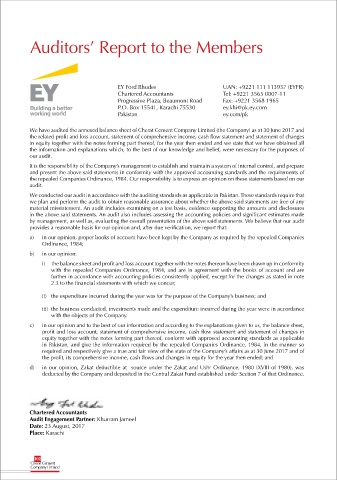

Auditors’ Report to the Members

EY Ford Rhodes UAN: +9221 111 113937 (EYFR)

Chartered Accountants Tel: +9221 3565 0007-11

Progressive Plaza, Beaumont Road Fax: +9221 3568 1965

P.O. Box 15541, Karachi 75530 ey.khi@pk.ey.com

Pakistan ey.com/pk

We have audited the annexed balance sheet of Cherat Cement Company Limited (the Company) as at 30 June 2017 and

the related profit and loss account, statement of comprehensive income, cash flow statement and statement of changes

in equity together with the notes forming part thereof, for the year then ended and we state that we have obtained all

the information and explanations which, to the best of our knowledge and belief, were necessary for the purposes of

our audit.

It is the responsibility of the Company’s management to establish and maintain a system of internal control, and prepare

and present the above said statements in conformity with the approved accounting standards and the requirements of

the repealed Companies Ordinance, 1984. Our responsibility is to express an opinion on these statements based on our

audit.

We conducted our audit in accordance with the auditing standards as applicable in Pakistan. These standards require that

we plan and perform the audit to obtain reasonable assurance about whether the above said statements are free of any

material misstatement. An audit includes examining on a test basis, evidence supporting the amounts and disclosures

in the above said statements. An audit also includes assessing the accounting policies and significant estimates made

by management, as well as, evaluating the overall presentation of the above said statements. We believe that our audit

provides a reasonable basis for our opinion and, after due verification, we report that:

a) in our opinion, proper books of account have been kept by the Company as required by the repealed Companies

Ordinance, 1984;

b) in our opinion:

i) the balance sheet and profit and loss account together with the notes thereon have been drawn up in conformity

with the repealed Companies Ordinance, 1984, and are in agreement with the books of account and are

further in accordance with accounting policies consistently applied, except for the changes as stated in note

2.3 to the financial statements with which we concur;

ii) the expenditure incurred during the year was for the purpose of the Company’s business; and

iii) the business conducted, investments made and the expenditure incurred during the year were in accordance

with the objects of the Company.

c) in our opinion and to the best of our information and according to the explanations given to us, the balance sheet,

profit and loss account, statement of comprehensive income, cash flow statement and statement of changes in

equity together with the notes forming part thereof, conform with approved accounting standards as applicable

in Pakistan, and give the information required by the repealed Companies Ordinance, 1984, in the manner so

required and respectively give a true and fair view of the state of the Company’s affairs as at 30 June 2017 and of

the profit, its comprehensive income, cash flows and changes in equity for the year then ended; and

d) in our opinion, Zakat deductible at source under the Zakat and Ushr Ordinance, 1980 (XVIII of 1980), was

deducted by the Company and deposited in the Central Zakat Fund established under Section 7 of that Ordinance.

Chartered Accountants

Audit Engagement Partner: Khurram Jameel

Date: 23 August, 2017

Place: Karachi

102